Learner needs are important—but, in the context of learning businesses, learner wants are just as important. Correctly satisfying these needs and wants requires figuring out what to offer—not by assuming or guessing what’s needed in the market but by following processes and systems that yield the data to prove it.

In this third installment in our seven-part series focused on learning science for learning businesses, we explain why performing market and needs assessments are critical steps in effectively applying learning science because, to be able to apply learning science to specific content, we have to know what that content is. We also discuss the Market Insight Matrix, a tool we created that treats assessment as a process rather than an event.

To tune in, listen below. To make sure you catch all future episodes, be sure to subscribe via RSS, Apple Podcasts, Spotify, Stitcher Radio, iHeartRadio, PodBean, or any podcatcher service you may use (e.g., Overcast). And, if you like the podcast, be sure to give it a tweet.

Listen to the Show

Access the Transcript

Download a PDF transcript of this episode’s audio.

Read the Show Notes

Market Assessment Versus Needs Assessment

[00:21] – Market assessments and needs assessments are related but different.

- A needs assessment is a process for identifying gaps between current conditions and desired conditions and then addressing those gaps. In the case of learning businesses, those needs are usually tied to content that individuals need in order to know or do something.

- A market assessment (sometimes called a market analysis) analyzes a learning business’s assets and activities to determine strengths and weaknesses and a learning business should do to best position its brand to take advantage of its market and audience.

We think of market assessment as more organizationally focused and needs assessment as more learner-focused or product-focused. A market assessment is about understanding the profession, field, or industry your learning business serves; knowing the other options learners in that space have; and determining how you can best support excellence in that profession, field, or industry through the products and services that you offer.

A needs assessment is about understanding learner needs and learning gaps so you can design and offer specific learning opportunities that will help close those gaps. Needs assessment and market assessment overlap, of course. You need to understand how your learners perceive their needs and therefore how they’re going to perceive your products and make sure that you’re developing the right products and positioning them in the right way in the market.

We also think of market assessment as addressing the question of “What will people buy?” and needs assessment as addressing the question “What positive impact will we create for the learner?” The two questions are—or at least should be—completely related, but learning businesses often emphasize one over the other, focusing, for example, on what they think learners need versus what will actually sell or vice versa.

When you are focused on what learner needs, you are going to ask questions about the challenges and opportunities the learners—or their employers—are currently facing; work to identify the specific knowledge, skills, attitudes, and behaviors needed to address those challenges and opportunities; and then determine the learning experiences that will help produce the needed knowledge, skills, attitudes, and behaviors.

When you are focused on market assessment, you are concerned about how large the market is, the other options learners have in the market, what their buying behaviors are, how price-sensitive they are, and how aware they are of your offerings.

Perception matters in both cases. You have to understand how members of the audience you aim to reach perceive their context and their specific needs. You’ll either need to align with those perceptions or determine ways that you can influence those perceptions to attract learners to the experiences you offer.

You do the market assessment and needs assessment to understand the current situation and perception. That doesn’t mean you have to accept that status quo as the “right” or only way to do things. You can work to influence and change perceptions. That’s arguably a harder tack to take, but it’s also one that can really stand you out from competitors, and it’s a tack that can really allow you to influence and change the field, profession, or industry you serve for the better.

Celisa Steele

With those descriptions in mind, let’s turn to the relationship between these kinds of assessment and learning science. Why do we include market and needs assessments in a discussion of learning science?

Assessment’s Relationship with Learning Science

[04:54] – To answer that question, let’s revisit at how we defined learning science in episode one of this series. Learning science is an interdisciplinary field devoted to better understanding how learning happens and then applying that understanding to creating and improving instructional methods, curricula, learning environments, and more. The curricula, learning environments, and materials that get developed involve specific content.

In order to apply learning science in context—i.e., in order to apply learning science to specific content—we have to know what that content is. Market assessment and needs assessment are how we determine what that content is. Just as learning science focuses on getting verifiable evidence of which learning approaches work best, these kinds of assessments allow us to determine the content not by assuming or guessing what’s needed in the market but by following processes and systems that help us ensure the content is what learners need.

The idea of systems and processes is critical because, ideally, you want to leave as little of this to chance as you can. That’s a key reason we’re talking about market and needs assessment as part of a conversation about learning science: There are scientific ways to go about them.

Jeff Cobb

That may seem obvious, but we often see situations where learning businesses have not been scientific, where they have not really followed systems and processes to assess their market and learner needs. But the lack of system or process is at the root of the whole “We built it, and they didn’t come” problem we hear about so often.

We keep using the word process because assessment should be something that takes place over time. That doesn’t mean there’s not value in taking snapshots in time, like you would with a typical needs assessment survey, for example. It just means you shouldn’t rely solely on that—you need to have methods in place of observing and engaging with prospective learners over time to get a truer sense of their situation, their challenges and problems, and how they behave.

In addition to treating assessment as a process rather than a snapshot in time, you should also bring a scientific mindset to it. Treat your ideas about market and learner needs as theories, and you are always searching for evidence to prove or disprove those theories. That’s the essence of the scientific method.

Market Insight Matrix

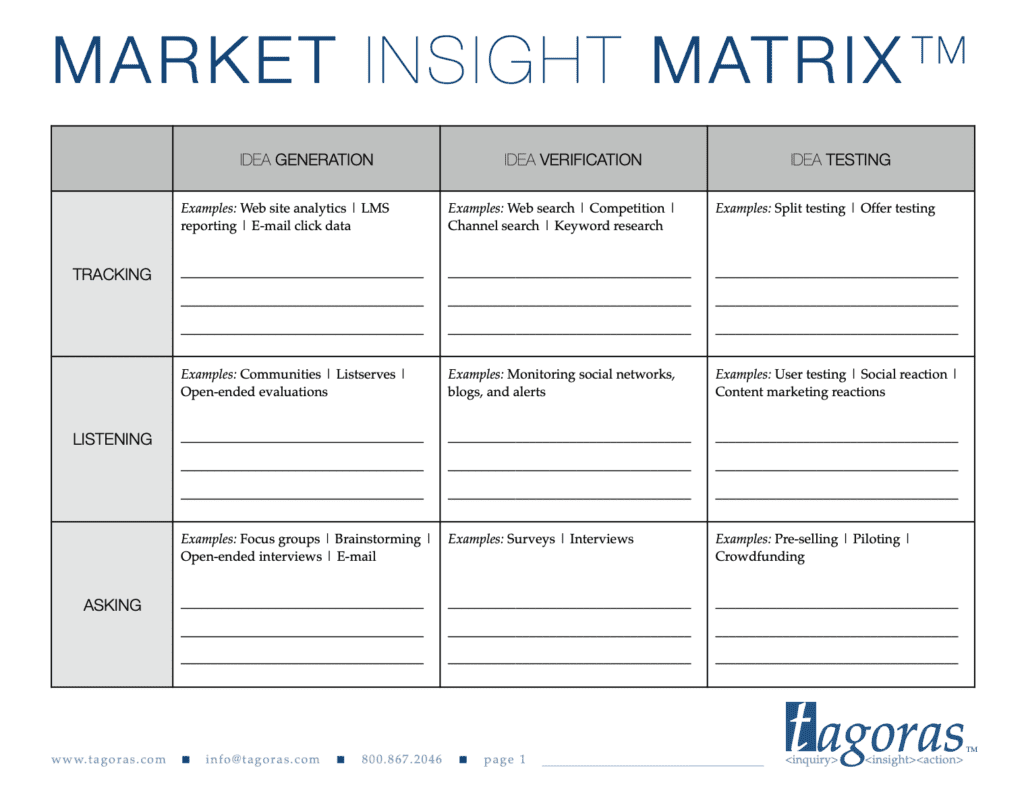

[7:40] – We have developed a tool for supporting this approach called the Market Insight Matrix. The matrix that lays out market assessment according to three stages and three types of activity.

The Market Insight Matrix lays out three stages in market assessment:

- Idea generation

The higher the quality of the ideas you come up with initially, the easier and more effective the subsequent parts of the market assessment will be. You want diverse input at this stage. Don’t rely only on the input of your education committee. You also need input from staff and volunteers, important customers, and influencers in your market. - Idea verification

In our experience, many organizations effectively stop at the idea generation stage. They come up with a few good ideas, prioritize one or two of them—often based on the thinking of a small number of people in the organization—and then begin building a product. A better approach is to take the ideas generated in stage 1 and verify them by looking at what Web searches, customers’ and prospects’ discussions in social media, and surveys and polls can tell you. - Idea testing

To test the idea, put the concept—or even a version of the product (maybe a minimum viable product)—into the market place and see if you can get people to take action. Will they sign up for future notifications via a landing page? Can you pre-sell the product and thereby ensure purchases from the get-go?

[09:33] – The stages are one key part of the process. The next part is the types of activities you should engage in across these stages. These fall into three main categories:

- Tracking focuses primarily on historical, quantitative data. What can you tell—based on a variety of tools like Google Analytics, Google Trends, and data from your e-commerce and learning management systems—about the behavior of your members and customers in the recent past? What content has been of interest? Where have they found it?

- Listening is another activity. Listening focuses on observing what your members and customers are saying and doing. What are they saying as they interact with each other, your organization and its offerings, even your competitors and their offerings? You can find out by monitoring social media, conducting user testing, or mining evaluations.

- Asking involves you engaging directly with stakeholders and requesting their input on specific questions. This is the path of traditional tools like surveys and focus groups but also includes activities like pre-selling and crowdfunding.

One of the asking activities you can use to assess your market is the tried-and-true focus group. Here are 5 Tips to Focus Your Use of Focus Groups.

Combine the three stages and the three activity types, and we get the Market Insight Matrix. You can use the matrix for identifying and then implementing the specific ways in which you will engage in market assessment over time. It’s a simple tool, but it brings a lot more clarity—and more rigor—to the process.

The key to the kind of assessment approach we’re advocating here—and it’s equally true of market assessment and learner needs assessment—is putting yourself in a position to gather, analyze, and then leverage valuable data about your learners.

Thinking about assessment—and particularly assessment as an ongoing process versus a one-off or even periodic event—reminds us comments Brenda McLaughlin, the CEO of SelfStudy, said when we spoke with her. She talked about blending learning and assessment and how constantly reinforcing strengths and filling gaps and weaknesses with the materials available. This is a natural next step in assessment, moving from a more general needs assessment, which guides content design and development, to specific-to-the-individual, specific-to-the-content assessments that happen in the moment.

When that happens, assessment really then is a process. It gets baked into the process rather than being something separate and discrete, and it’s certainly not a one-off event in that context. And that kind of attention to assessment helps learners fill gaps and reinforce strengths.

Celisa Steele

Sponsor: SelfStudy

[15:26] – SelfStudy, our sponsor for this series, is harnessing artificial intelligence to help organizations assess and address learners’ needs in real time.

SelfStudy is a learning optimization technology company. Grounded in effective learning science and fueled by artificial intelligence and natural language processing, the SelfStudy platform delivers personalized content to anyone who needs to learn either on the go or at their desk. Each user is at the center of their own unique experience, focusing on what they need to learn next.

For organizations, SelfStudy is a complete enterprise solution offering tools to instantly auto-create highly personalized, adaptive learning programs, the ability to fully integrate with your existing LMS or CMS, and the analytics you need to see your members, users, and content in new ways with deeper insights. SelfStudy is your partner for longitudinal assessment, continuing education, professional development, and certification.

Learn more and request a demo to see SelfStudy auto-create questions based on your content at selfstudy.com.

Needs and Wants

[16:41] – Learner needs are important—but, in the context of learning businesses, learner wants are just as important. Your learners most likely have other options and choices, so offering what they need along with what they want increases the chances that they’ll opt for you out of the sea choices available to them.

That jibes with the comments Megan Sumeracki made in episode 273 when talking about captive audiences (like high school students) versus the adults served by learning businesses who have usually have choices about what learning to engage in or not. She pointed out that enjoyment, which might lead to higher engagement and motivation, might be more important in non-captive situations, meaning learner needs (which would dictate content) can be married with learner wants (are learners enjoying the learning?) to create an extra potent offering. Ideally, learning businesses give learners both what they need and what they want.

It can be easy to get overly focused on what we feel learners should be doing or achieving (what usually corresponds with what we mean by “needs”), but it’s also really critical to understand what they actually want to be doing when it comes to learning.

An important twist on that is that asking learners directly about what they want can often result in misleading or invalid data. Learning businesses tend to be fond of asking prospective learners about their preferences, but it’s hard to do that in a way that doesn’t influence the answer. Plus, in many cases, learners don’t have enough experience to say—and, even if they do, preferences are generally a poor predictor of behavior. Our view is that you need to ask about behaviors, not preferences, to get at what learners want.

For example, instead of asking if they would prefer a self-paced online course or an instructor-led Webinar series, ask if they have taken a self-paced online course before or participated in an instructor-led Webinar series. That helps you get at behavior rather than preference.

That’s an approach we talked about in more detail in a past episode titled “Give the Learners What They Want,” where we talked about four key areas of gathering and assessing data. Assessing behavior rather than preferences is one of them, but we also discuss the following areas:

- Understanding your demand dynamics

Often your greatest evidence for what your customers will want in the future is what they have already been buying or what they have been looking for—and, to the extent you can determine, why? - Identifying key value factors

It’s important to know the factors prospective customers weigh when making purchase decisions. You’ll want to get a clear read on which variables significantly raise or lower value in the eyes of your learners. These might be things like presenter’s reputation or the results that past participants have attributed to their participation in a course. - Gauging commitment and conversion, not interest

Frequently learning businesses will ask prospective customers whether they are interested in a particular offering. A lot of times what happens is that people say they are interested, but then very few sign up when the course—or whatever the product is—is actually offered. We offer some ideas of how to get at commitment and how to convert in that “Give the Learners What They Want” episode.

[21:50] – To add some perspective, we spoke with Myra Roldan, a seasoned technologist and learning professional, who we’ll hear more from later in this series. She talked about the importance of understanding your audience and provided some concrete examples of how knowing your specific audience can and should inform choices about the design, development, and delivery of offerings. Knowing your audience comes from the kinds of intelligence and insight you can get from market assessments and needs assessments.

Myra’s comments get not just at content but also the format and the importance of really understanding what’s going to be appealing to and possible for your your learners. You want to use the right methods to achieve the desired learning outcomes, but those methods can come in a variety of formats and media.

[24:52] – Wrap-up

Remember to check out the Market Insight Matrix, a free resource that may prove helpful if you’re looking for a do-it-yourself tool to help you with market assessment.

To make sure you don’t miss the remaining episodes in the series, we encourage you to subscribe via RSS, Apple Podcasts, Spotify, Stitcher Radio, iHeartRadio, PodBean, or any podcatcher service you may use (e.g., Overcast). Subscribing also helps us get some data on the impact of the podcast.

We’d also appreciate if you give us a rating on Apple Podcasts by going to https://www.leadinglearning.com/apple.

We personally appreciate your rating and review, but more importantly reviews and ratings play a big role in helping the podcast show up when people search for content on leading a learning business.

Finally, consider following us and sharing the good word about Leading Learning. You can find us on Twitter, Facebook, and LinkedIn.

[26:07] – Sign-off

Other Episodes in This Series:

Episodes on Related Topics:

Effective Learning with Learning Scientist Megan Sumeracki

Effective Learning with Learning Scientist Megan Sumeracki

Leave a Reply