We’ve reached our next-to-last installment in our learning business MBA series, where we’re continuing to explore the question “What kinds of skills, knowledge, and behaviors do learning businesses need to be successful?”

A common theme has emerged as an answer. (1) You have to know your market and audience, and (2) you have to get product development right. But there’s another component that too often does not get added—or doesn’t get added with enough discipline and consistency—and that’s financial modeling. But it’s critical that learning businesses do the financial projections to establish that their right audience and right product add up to a financially viable offering.

That’s why in this sixth episode in our learning business MBA series we’re offering a crash course on the basics of financial modeling for learning products. We discuss why you need to start with an irresistible offer and what to consider in terms of time horizon, projected revenue, cost of sales, and expenses. We also share the many ways financial modeling can be used to help grow and improve your learning business.

To tune in, listen below. To make sure you catch all future episodes, be sure to subscribe via RSS, Apple Podcasts, Spotify, Stitcher Radio, iHeartRadio, PodBean, or any podcatcher service you may use (e.g., Overcast). And, if you like the podcast, be sure to give it a tweet.

Listen to the Show

Access the Transcript

Download a PDF transcript of this episode’s audio.

Read the Show Notes

Show Notes

[00:25] – Intro

Your Irresistible Offer

[01:28] – To do good financial modeling, you need to be clear on your offer, and, ideally, you need to have an irresistible offer. We’ve recently been reminded of the concept of the irresistible offer by our colleague Danny Iny, CEO of Mirasee, a company that works with entrepreneurial course creators to create, launch, and sell online courses. (Check out our past episode “Leveraged Learning with Danny Iny.”)

To come up with an irresistible offer, you have to be clear on the target audience. There’s an important distinction between market and audience. The target market is the whole group of people or organizations that your learning business wants to sell to. The target audience is narrower—it’s a subset of the target market. It’s the group of individuals or organizations that your learning business expects to buy a particular learning product.

To be clear on the target audience, document it. This documentation might take the form of basic demographics—age range, socioeconomic status, educational attainment, etc.—or you might get into personas or customer avatars. Note that a simple text description that helps you and everyone on your team be clear about your target audience is significantly more important than developing slick personas with mock photos, pithy bios, and made-up names.

In addition to being clear on your target audience, you have to be clear on your offer. This can also take the simple form of text that describes what you’re offering. You need to be clear on what it is, how it works, and what it costs. When thinking about what it is, think about the competitive factors that we discussed in “The Strategy and Marketing Episode,” when we talked about blue ocean strategy and the strategy canvas. Know the competitive factors in your market—that is, the factors on which organizations tend to compete in order to win customers. Address the relevant factors in your offer, and, in keeping with blue ocean strategy, maybe zig where others zag, or add in some factors that competitors may not be considering.

[05:11] – You don’t need a fancy prototype or detailed content outline initially. It’s okay and even best to start with a simple text description that’s easy to update and change. It’s easier to get input from a wide variety of stakeholders if you’re only dealing with text, so we recommend that you start there. To make your offer appealing—or, better yet, irresistible—it needs to be perceived as delivering more value than it costs. To create irresistibility, draw on relevance, credibility, and urgency.

Relevance crosses the lines between business and adult learning because we know how important relevance is to the adult learner. Adult learners need to know that what you’re offering applies to them and that they’re going to be able to apply it in their life and in their work and get some sort of return off of it. That has to be part and parcel of the educational experience, and that makes it part and parcel of the overall offer.

Credibility is about describing why learners should learn from you. There are probably others that offer learning options on the same or very similar subjects, so think about what makes yours better and different.

Urgency drives customers to buy from you. How is that sense of urgency created? Examples include things such as early bird specials or other tiered pricing, end-of-year credit renewal windows, or new regulations.

An Irresistible Offer Still Warrants Financial Modeling

[09:26] – Even if you have an offer that’s relevant, credible, and urgent, that’s not enough. You need to then do the financial modeling to know whether there’s a sufficient return on investment in pursuing this irresistible offer.

It’s hard enough to do the work and do it really well to get to the irresistible offer. And a lot of organizations don’t even get that far. But, even if they do that, they then often don’t take the step after that and do the hard work to really lay out the financials for this. Look at the revenue, look at the costs, look at the factors that are going to make this sell or not sell in the marketplace, and map out that financial story to see if they’ve actually got a viable product or not. Even if it’s irresistible, you still got to sell enough of it to actually make ends meet at the end of the day.

Jeff Cobb

In the first episode in this series, we credited Josh Goldman, now director of consulting at Tagoras, for the term “the learning business MBA.” When talking about the skills and knowledge needed for learning businesses to succeed, we mentioned to him that we’ve often seen organizations not be clear about their margins and their costs for their learning portfolio, and rarely have we seen organizations be clear at the product level. Josh shared that he’s encountered that lack of product-level P&Ls both in his past jobs and also now in his role at Tagoras.

If you don’t have an accurate representation of both potentially the gross revenue but also then the net profit, so to speak, how are you making decisions about which programs to invest, reinvest, or divest from if you can’t get that view?… I think there’s the balance between how to get enough value out of the manual time spent in adding some of those data points to your analysis versus not having access to that information and trying to make judgment calls on to what degree of accuracy do you need to have in the financial portfolio review. Does it need to be a scalpel, or could you get away with a steak knife, so to speak, analogy?

Josh Goldman

We think you should do your financial modeling, but, using Josh’s analogy, you don’t necessarily need to worry about scalpel-like precision. You just need to get a good sense of what’s possible and probable. To help you do that, we’ll cover the basics of financial projections for professionals working in and running learning businesses.

The Basics of Financial Modeling for Learning Products: Revenue

[13:04] – When working on financial projections for a learning product or service, one consideration is the time horizon. Three to five years is often an appropriate time horizon when looking at getting a new learning product off the ground. Costs are usually higher in the first year or years, and then margins tend to ratchet up over time. Your time horizon may vary, but you you want to look far enough out to get a fairly clear picture of what the return might really be but not so far out that the projections begin to lose their value because they become pure conjecture.

Across your chosen time horizon, you need to look at three things: projected revenue, cost of sales, and expenses. Once you have those, you can subtract the cost of sales and other expenses from the projected revenue to arrive at projected net, or profit. The goal with projections is to get your learning business a clear idea of net revenue, or profit, because that’s the bottom line—literally.

There are a few key variables you’ll need to be able to project revenue related to learning products:

- The number of enrollments or items sold

- The price for the product

- The annual growth rate

In year one, the number of enrollments or items sold might be relatively low as you do the work to make prospective customers aware of your product. Then you might ramp up more in years two and three, and then settle into a more modest rate of growth after that. An “annual growth rate,” as a term, sounds like it’s all about getting more and more learners to buy, and it is. While that’s a great goal to have in mind, make sure that your annual growth rate takes into account learners that you might lose each year.

We’ll also highlight that we called these aspects of revenue—the number of enrollments, the price, and the annual growth rate—variables, and they can vary. They’re usually educated guesses, which means there is likely a range of reasonable numbers to insert for any of these values. So make it possible to change them and have those changes be automatically reflected across your projections. This gives you the ability to see immediately how changing the price point may impact your gross and net revenues and how much difference higher or lower penetration rates or annual growth rates can make.

Sponsor: Cadmium

[18:17] – If you’re looking for a technology partner to help you grow your learning business year over year, please check out our sponsor for this series.

The COVID-19 pandemic catalyzed the merging of events and education for organizations across the globe. Organizations have realized that synergizing their education and events strategies produces immeasurable benefits, but they need a technology solution that facilitates that merge.

Cadmium is focused on providing a full suite of technology solutions enabling organizations to meet the changing environment head on. From a host of event technologies to integrated learning management and content creation tools, Cadmium offers everything an organization needs to generate revenue and drive engagement.

Learn more, and request a demo to see how Cadmium can help your learning business at gocadmium.com.

The Basics of Financial Modeling for Learning Products: Cost of Sales, Expenses, and Margin

[19:17] – Cost of sales are expenses that can be attributed directly to creating, delivering, and maintaining the learning product. Some of those costs are one-time, and some are recurring. Assuming you have more than one learning product, you might determine a reasonable percentage of your LMS, Zoom, or other software costs to allocate to each of your products. Also, some costs of sales happen every time a learning product is offered (paying an instructor for a classroom-based course), and cost of sales might include royalties to subject matter experts or other sources if your learning product is based on licensed content.

Expenses cover indirect cost related to creating, delivering, and maintaining the product. These include staff costs—not the staff instructional designer working on the course (that would be a cost of sales) but your time overseeing that ID, for example. Expenses also include marketing and sales, which are a critical part. If you end up with high cost of sales and thus low gross margins, that cuts into what you can afford to spend on sales and marketing. In our experience, most organizations do under-spend on sales and marketing.

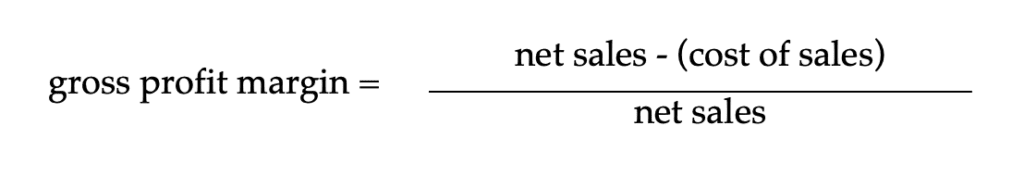

Note that what gets classified as a cost of sales versus an expense may vary a bit from organization to organization. The main thing is to make sure you account for the direct and indirect costs of creating, delivering, and maintaining a learning product. Once you have your revenue numbers and your cost of sales and expenses, you’ll be able to see your gross margin for the product. Gross margin is a profitability ratio that speaks to the financial wellbeing of a product. Gross profit margin is computed by dividing net sales less cost of goods sold by net sales.

Higher gross margins mean a greater ability to invest in sales and marketing—or simply an increase in net margin. The net margin further removes the values of interest, taxes, and other operating expenses from net revenue to arrive at a more conservative figure. Note that digital offerings generally have higher gross margins, mostly because they don’t require investing in things like facilities or travel for speakers. That doesn’t necessarily mean you’ll have higher net profit because you may decide to invest more in sales and marketing to get the enrollment levels you desire for these products.

How Financial Modeling of Learning Products Can Be Used

[24:15] – We’ve worked with many organizations over the years in our consulting work to help them develop financials to make informed decisions. Broadly speaking, the ways that this type of financial modeling can be helpful is in three areas—deciding whether to invest, reinvest, or divest.

We’ve focused so far mostly on financial projections—the financial modeling done to help a learning business understand what might be involved to launch a new product and make it profitable. That’s a clear use case, one where we don’t see enough organizations do the work to really understand what creating and maintaining a new product might involve. If you work with the types of projections we’re talking about here, you have variables you can play with to create a picture of what the financials for a product are likely to look like across whatever time horizon you choose.

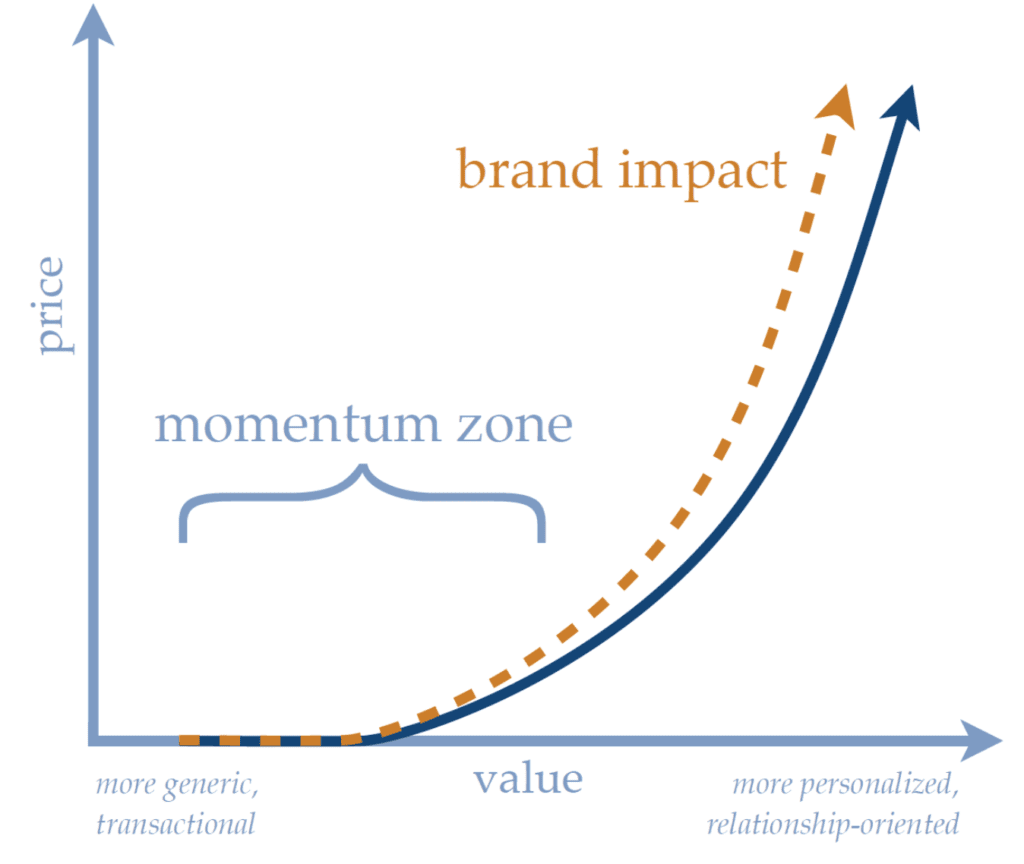

You can also use a tool like the Value Ramp™ to help you look at the logic of your portfolio and how things are priced. (Check out our episode “8 Tips for Optimizing Your Value Ramp.”)

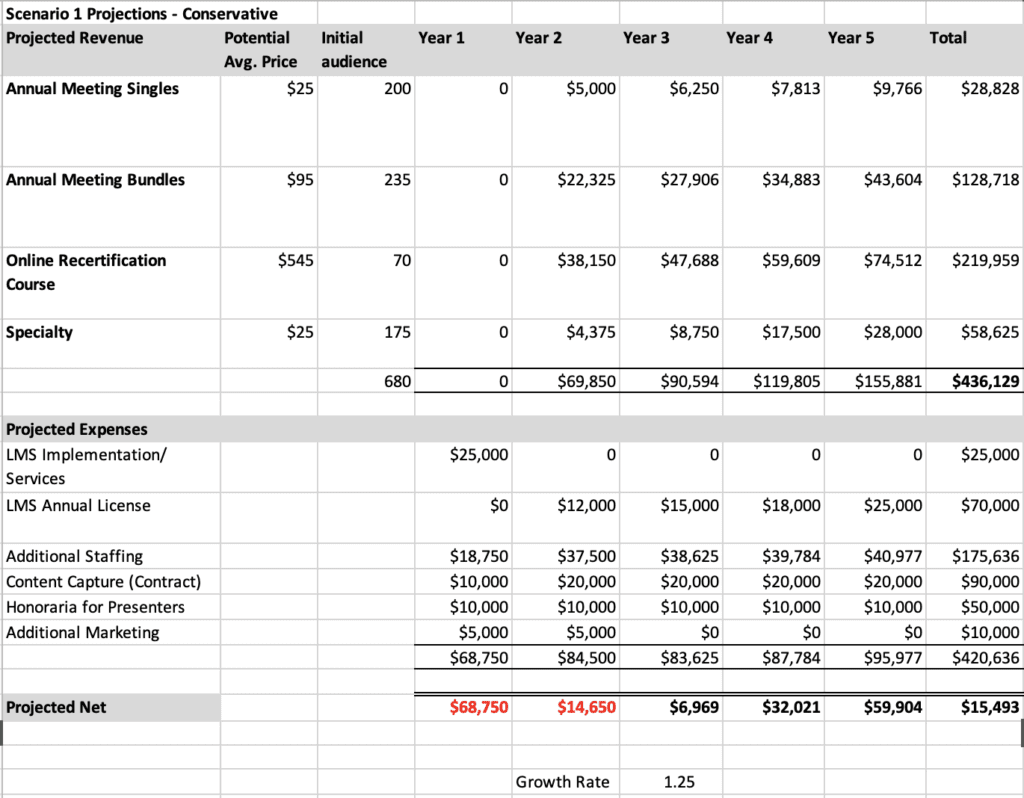

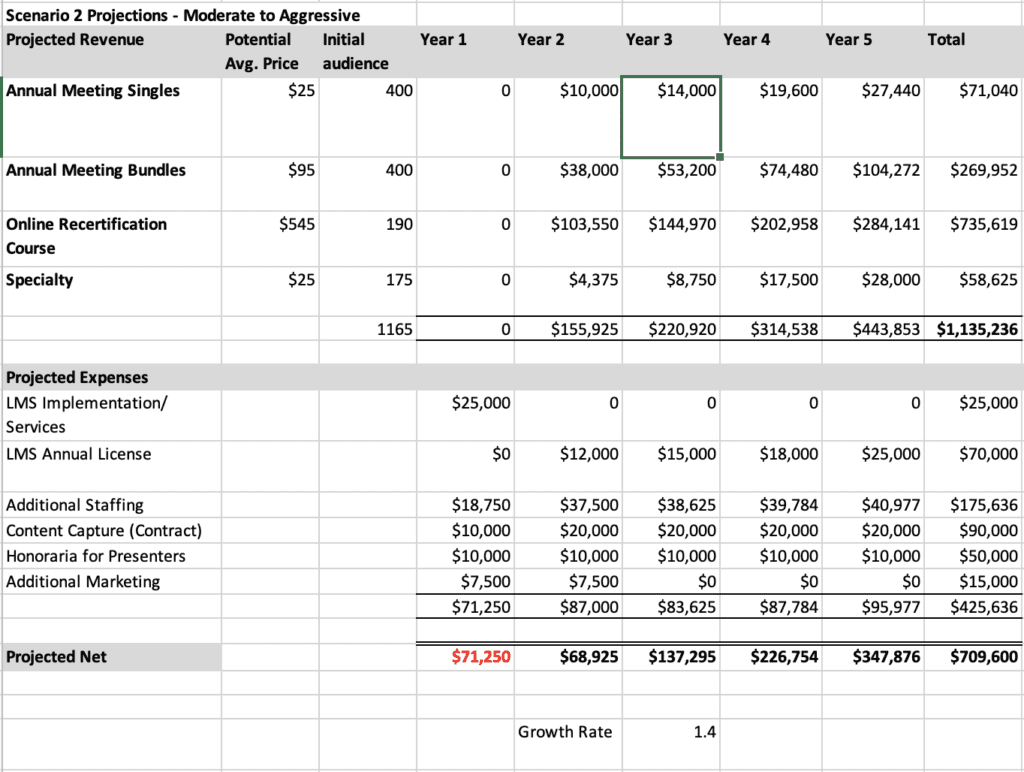

With one learning business, we ran two scenarios, one based on more conservative variables and the other based on more aggressive penetration and growth.

Using conservative estimates for the growth rate and penetration rates, the learning business was projected to lose some money the first two years but to then start to make money.

In a more aggressive scenario, the learning business would start making money sooner and make bring in significantly more net revenue over the five-year time horizon. We noted assumptions in the spreadsheets where we made the projections, so that those reviewing the financials could see what we’d thought through and been logical about. This result is a clear, cohesive vision of what might happen with a learning product, and that becomes an excellent a communication tool for staff and other stakeholders, such as boards.

[27:37] – These kinds of financial projections can be used to inform go/no-go decisions, and they can also be used to help make the decision to divest, to sunset a product. Many organizations get to the point where they realize something in their portfolio isn’t working as well as they hoped it would, but they still believe there’s a need there.

Maybe you don’t quite have the right product aligned with the right audience, so you rethink it and try out a new product or a reconfiguration. In that case, you have historical data and financials on the product being sunset. You can line up financials for what you’re planning against it and look at how the new product might help you replace or even surpass past revenue over time.

[29:01] – There are multiple ways a learning business can use financial modeling:

- For go/no-go decisions on new products

- To look at the impact of sunsetting a product

- To assess new revenue models or new business models (For example, you could compare a business-to-business versus business-to-consumer approach for a product or look at what moving to a subscription model might mean versus selling single products to individual learners.)

- To compare products in your portfolio (Seeing different margins on different products might give you ideas about which products to focus on.)

- To see what each product contributes to your overall revenue (This can help you do some risk assessment if, for example, your revenue is highly dependent on a single product.)

- As a communication tool and learning tool as you and your team continually revisit your assumptions and recalibrate based on reality

[34:38] – Remember that you need to track financial performance over time—this isn’t a one-and-done thing. Assuming you move ahead with developing and delivering a product, check back against those projections to see how it’s panning out. If it is panning out exactly as you projected, that’s great—but that hardly ever happens. If your projections are off, then use it as a chance to learn and ask questions. If you’re not hitting the numbers you thought you could, why not? Is it the price? Is it the penetration? Are you reaching the right people with the product? Do you need to do some things to the product to make it more attractive to the audience?

You need to collect the data. You need to compare it to the projections that you had put in place. You need to look at the discrepancies and discuss them. It’s a chance for course correction. It’s a chance for potentially just pulling the plug. It’s a chance for doubling down…. If you’re just really blowing it out of the water, it’s a chance to think about developing related or complementary products or expanding to adjacent audiences. So, in short, financial modeling really allows for data-driven decision-making, for informed decision-making.

Celisa Steele

[36:31] – Wrap-up

Reflection Questions

We’ll offer some reflection questions for you to ponder:

- How buttoned up are you about financials?

- Are there any products you need to update or see about sunsetting?

- Do you have any new product ideas to test out?

To make sure you don’t miss the remaining episodes in the series, we encourage you to subscribe via RSS, Apple Podcasts, Spotify, Stitcher Radio, iHeartRadio, PodBean, or any podcatcher service you may use (e.g., Overcast). Subscribing also helps us get some data on the impact of the podcast.

We’d also appreciate if you give us a rating on Apple Podcasts by going to https://www.leadinglearning.com/apple.

We personally appreciate your rating and review, but more importantly reviews and ratings play a big role in helping the podcast show up when people search for content on leading a learning business.

Finally, consider following us and sharing the good word about Leading Learning. You can find us on Twitter, Facebook, and LinkedIn.

Other Episodes in This Series:

- Learning to Get Down to Business

- The Strategy and Marketing Episode

- Studying Innovation with Mary Byers

- Learning Diversification with Jim Obsitnik

- MBA Student for a Day with Steven Schragis of One Day U

Episodes on Related Topics:

MBA Student for a Day with Steven Schragis of One Day U

MBA Student for a Day with Steven Schragis of One Day U

Leave a Reply