What do you get when you cross a lack of strategy with an absence of process and a failure to use data for decision-making? It’s no joke that what you get is a maturity gap—and the findings reported in Association Learning + Technology 2017 make it clear that just such a maturity gap exists for many membership organizations.

Continuing the work of four prior reports, Association Learning + Technology 2017 is based on the results of an online survey of membership organizations and assesses the use of technology to enable and enhance learning in the association market. The survey found that the prevalence of technology-enabled or technology-enhanced learning among associations is impressive—of the qualifying responses, 92.6 percent were from individuals whose organizations currently offer.

But what that use of technology for learning looks like for many associations is much less impressive.

The Strategy Vacuum

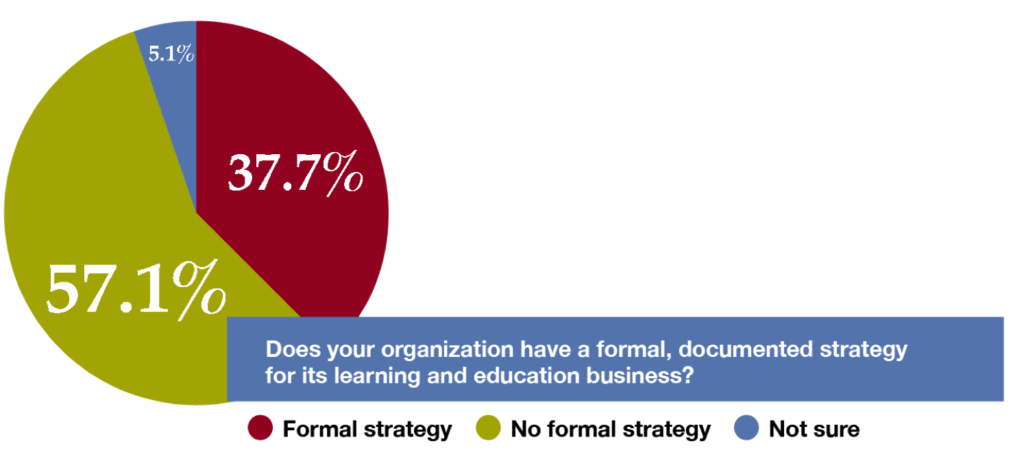

Well under half (37.7 percent) of all survey respondents reported having a formal, documented strategy in place to guide their learning and education business, and under a quarter (23.0 percent) of respondents using technology for learning reported no formal, documented strategy to govern how technology is used to enable or enhance learning.

In the current learning landscape, where competition continues to grow as barriers to entry fall away (tools and technologies are cheaper and easier than ever), this strategy vacuum is especially dangerous. It’s essential that associations have strategies in place to guide where they focus their limited resources for developing and marketing educational offerings and to guide how they use technology to support those offerings. If not, associations risk inefficiency, on one end of the spectrum, and, at the extreme, loss of learners and members to competitors.

The fact that professional development, education, and similar offerings are often revenue-producers for associations is another argument for strategy, which can help maximize the return on investment. The survey behind Association Learning + Technology 2017 shows a positive correlation between strategy and money—58.7 percent of organizations with a general strategy for their learning and education business report that technology has increased the net revenue of their educational offerings, compared to 42.7 percent of those without a general strategy, and 62.2 percent of those with a strategy that addresses the use of technology to support learning report that technology has increased net revenue versus only 44.6 percent of those without such a strategy.

Key Processes MIA

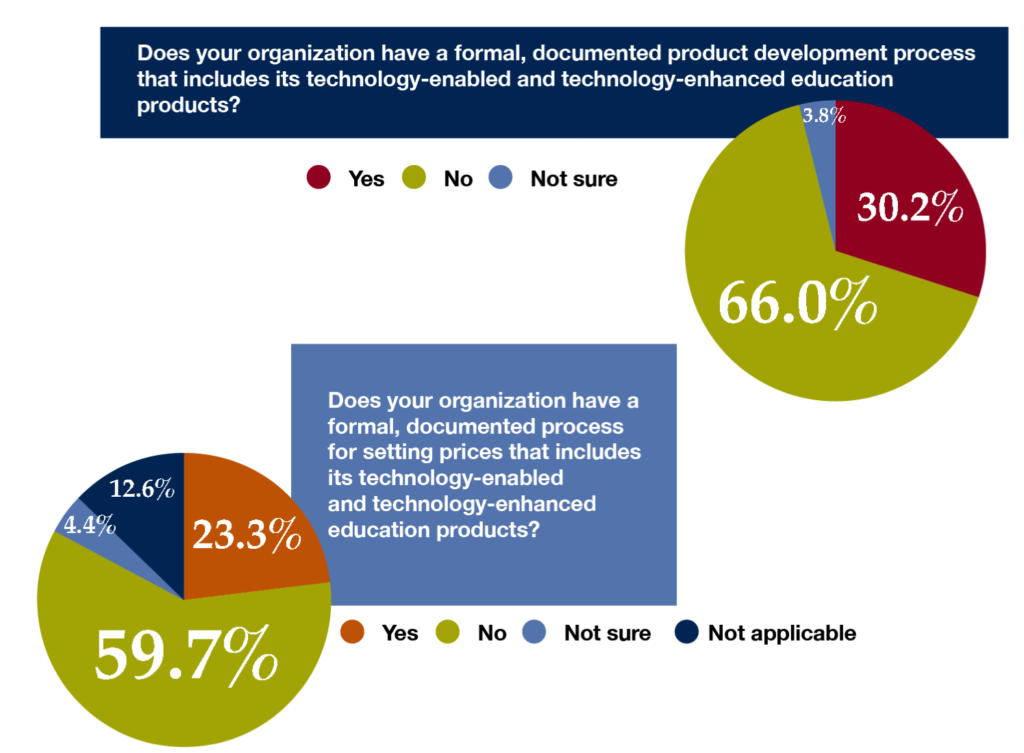

Just as strategy is lacking among the majority of membership organizations, key processes are missing in action too. Two-thirds (66.0 percent) of respondents whose organizations use technology for learning don’t have a formal, documented product development process that includes technology-enabled and technology-enhanced education products, and over half (59.7 percent) lack a formal, documented process for setting prices that includes their technology-enabled and technology-enhanced education products.

Without a product development process (which typically includes steps for determining which products or services to produce as well as the process by which products are created and taken to market), how are organizations going about product development?

From our interactions and work with associations at Tagoras, we know many rely on a committee, the board, or staff to suggest topics for educational offerings. While these groups are all important stakeholders, the input they provide can be biased and fail to represent the full range of learners the organization can reach.

It’s also common for associations to turn to evaluation data collected from current learners and surveys of the membership base to gauge interest in particular educational offerings or topics. But such feedback still has limitations—the biggest being what is often a discrepancy between what learning options people say want and what they actually buy.

A product development process that uses a mix of methods to assess the market and avoids overreliance on any one source, combined with pre-selling and experimenting with minimum viable products to gauge actual demand can save organizations a lot of effort and money. (Pre-selling is a concept we mention in the Market Insight Matrix, which can help you manage a rigorous but practical market assessment.)

An appropriate product development process, one that translates market opportunity into products available for sale, will feed naturally into an appropriate pricing process. To be clear, neither a cost-plus approach nor an approach that pegs prices to what competitors charge constitutes an appropriate pricing process in my mind. At Tagoras, we advocate value-based pricing (which underpins our Value Ramp tool).

The cost-plus approach can result in undercharging, if the learners value the product more highly than the derived price. And, on the end of the spectrum, organizations often fail to include (or at least fudge) their soft costs, like percentages of staff salaries, when taking a cost-plus approach.

Similarly, the competitor approach is also inherently limited; it reinforces similarity with other products when education should be a differentiator for your association—your learners should come to you for something they value and something unique. And that something unique and valuable is what your strategy will point to and your processes will allow you to develop and price appropriately.

Data’s Too-Frequent Absence in Decision-Making

When thinking about formulating a strategy and laying out key processes, data is your friend. You’ll want to blue-sky it at times, of course, but having data to ground and validate your decisions is important.

And not enough associations are taking advantage often enough of the data they have to inform decision-making. Only 14.9 percent of respondents that have one or more learning technology platforms in place reported always using the data they collect in their learning technology platforms to make decisions about the current and future educational products and services they offer.

True, 30.4 percent report frequently using that data for decision-making. But 35.7 percent report using it sometimes, and 4.8 say they never use the data to inform their portfolio decisions.

Use the data you have to inform product decisions. If you don’t, it’s a wasted opportunity to ensure your decision-making is based in reality and not swayed by confirmation bias.

The Punchline: Mend the Gap

If you want to make sure the maturity gap isn’t holding back your learning and education business, answer these questions:

- Do you have a formal, documented strategy for your learning business? Do you have a strategy for how you’re using technology for learning? Are the strategies shared and followed?

- Do key processes, like those for product development and pricing, exist? Are they followed and refined over time?

- Is the data you collect related to your educational offerings used to inform product decisions on a consistent basis?

If you answer no to any of the above, then filling, or mending, those gaps is a good place to focus efforts as you move towards running a more intentional and mature learning business. (We also recommend the Learning Business Maturity Model and assessment as part of this effort.)

Celisa

P.S. I’ve cited some data and findings from Association Learning + Technology 2017 in this article, but there’s lots more in the full report, which is available for free at https://www.tagoras.com/catalog/association-learning-technology. We designed the report for association leaders who want to be fully informed as they make strategic decisions about launching or growing their learning business—take advantage.

Blue Ocean Strategy for Your Learning Business

Blue Ocean Strategy for Your Learning Business

Leave a Reply