What if your organization could make the competition irrelevant and deliver unique value to the learners it serves? That’s the idea behind one of our favorite strategy books of all time, Blue Ocean Strategy: How To Create Uncontested Market Space And Make The Competition Irrelevant. And when it comes to embracing and formalizing strategy, many organizations in the business of lifelong learning have a tremendous opportunity for growth and improvement.

In this episode of the Leading Learning podcast, Celisa and Jeff discuss the concept of blue ocean strategy and some of the key tools you can use to create blue ocean for your learning business.

To tune in, just click below. To make sure you catch all of the future episodes, be sure to subscribe by RSS or on iTunes. And, if you like the podcast, be sure to give it a tweet!

Listen to the Show

Read the Show Notes

[00:18] – A preview of what will be covered in this podcast where Celisa and Jeff highlight one of their favorite strategy books of all time: Blue Ocean Strategy: How To Create Uncontested Market Space And Make The Competition Irrelevant.

Strategy is an important topic because it’s noted there is perhaps a strategy problem among organizations in the business of lifelong learning.

And this is backed by research in our recently released 5th edition of Association Learning + Technology report that showed only 37.7% organizations have a formal, documented strategy for its learning and education business which is quite low given the importance of this function.

Part of the reason we want to talk about Blue Ocean Strategy is because the follow up to that book – Blue Ocean Shift – has recently come out. The other reason is we feel it is such a practically useful book for organizations seeking to formulate a strategy for any sort of business, including learning businesses.

We actually highlighted the book in the past as one of our Emphatically Recommended Readings for the Leading Learning Symposium because strategy has been a major focus at the symposium.

What is “Blue Ocean strategy”?

[03:56] – Essentially, it’s an approach to strategy based on the idea that most organizations within any field or industry compete on the same basic factors. Price and features, for example, tend to be common ones.

As a result, everyone tends to look the same over time, and they compete fiercely to bite off their piece of the market, thus creating a bloody “red ocean.”

Organizations that embrace Blue Ocean strategy, on the other hand, “reconstruct” their markets and find wide-open waters where the sailing is smooth and competitors are nowhere to be seen and the waters are blue.

The core of how organizations do that is they raise the value of their offerings or create new value – value innovation – while simultaneously controlling or even reducing costs. So, you end up with an offering that is differentiated from the market and that has high margins—a place most organizations would like to be in with their offerings.

Most organizations in the market for lifelong learning are facing increasing levels of competition (whether they are fully aware of it or not).

Technology has made it dramatically easier for prospective competitors to develop an audience as well as to develop and distribute educational offerings in a variety of ways, whether online or off. At the same time, the offerings available to lifelong learners are increasingly generic.

In spite of what we may tell ourselves, there is generally not a lot to distinguish one conference, Webinar, or online course from another – at least not in the eyes of the learner. Most organizations faced with this situation try to outperform the competition by making incremental improvements in performance. But when everyone is competing on essentially the same factors, higher performance can only take you so far.

We’ve seen again and again that the effort of most organizations to make incremental changes becomes exhausting and demoralizing. Blue ocean organizations, on the other hand, never use the competition as a benchmark.

Instead they make it irrelevant by creating a leap in value for both buyers and the company itself.

So you can think, for example, of what Southwest was able to do in the airline industry by simply dropping many of the traditional aspects of airline travel (like in-flight meals) focusing, at least initially, on short haul flights, rather than the traditional hub and spoke model, and as a result, reducing its costs dramatically and passing those cost savings on to customers. The airline industry has never been the same.

That’s just one of many examples you will find in the book.

Tools to Help Develop Strategy

[07:14] – Organizations can—and do—get by without a strategy, but having a good strategy focuses efforts and expenditures and can allow for significant growth and improvement. And that’s why strategy is one of the five key domains we focus on in the Leading Business Maturity Model™.

Below are a couple of tools we’ve often used to help organizations develop strategy:

The Strategy Canvas

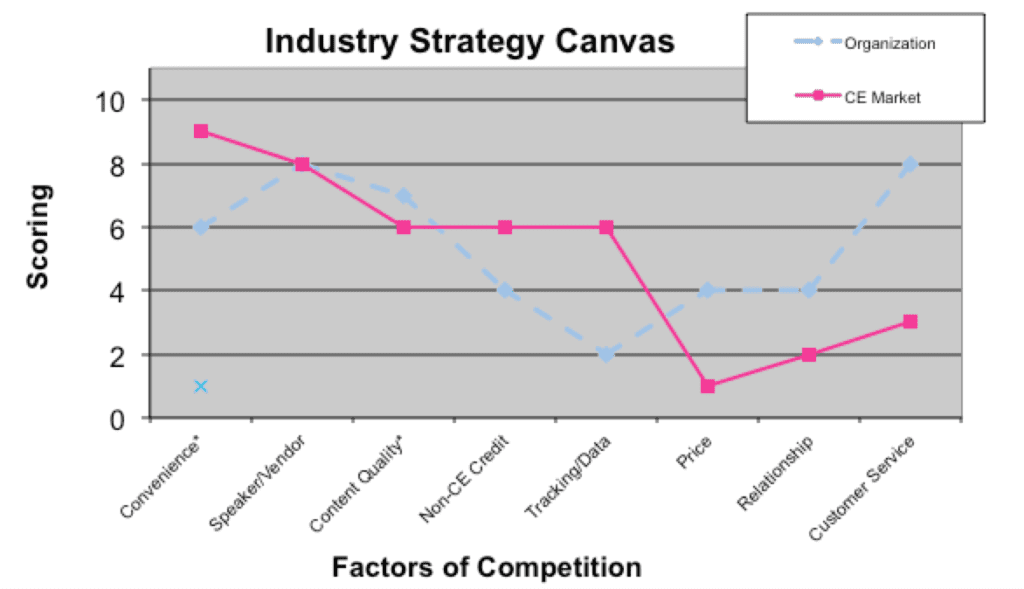

The strategy canvas is great because it can really help organizations understand their current situation much better.

And really understanding—objectively, honestly understanding your current situation–is one of the most fundamental elements of successful strategy formulation.

So, whether or not you are aiming for blue ocean, the strategy canvas is an incredibly useful tool.

The basic idea is that you really focus in on the competitive factors in your market – that is, what are the factors on which organizations tend to compete in order to win customers.

Price is almost always an obvious one. Certainly it is a factor in the continuing education and professional development market.

Other factors in that market include things like the reputation of the presenters or instructors, location and amenities like food in the case of face-to-face events.

It can include things like the availability of credit or the amount of access learners will get to the instructor or another expert for help.

Those are just a few of the possibilities.

What the strategy canvas helps you do is plot out those factors by rating (from low to high) the level of emphasis that different competitors place on those factors, and the level of emphasis that your organization places on them by comparison (or might place on them, if you have not yet entered the market).

This gives you a really useful visual of where things currently stand in the market, and just as importantly, it starts giving you ideas for how you might actually change your approach to the market (by increasing or reducing, maybe even eliminating) your emphasis on certain factors and possibly adding in new factors that no one seems to be competing on at this point.

We think it’s a really powerful and much more useful tool than something like the traditional SWOT analysis (strengths, weaknesses, opportunities, threats) on which so many organizations rely.

[11:33] –

The Six Paths Framework

This plays a big role in formulating Blue Ocean Strategy and we have actually done a whole series on this on the Tagoras blog and we’d like to highlight that as the resource for this episode. Although we won’t be able to do it full justice in the context of this single podcast episode, we thought would be useful to at least highlight what the framework enables you to do.

Essentially, the six paths framework helps you break out of your normal perspectives by—as authors Kim and Mauborgne put it—“looking across” the boundaries that tend to constrain how you normally do business. They offer six ways you can “look across.” These are:

- Looking across alternative industries

- Looking across strategic groups

- Looking across buyer groups

- Looking across complementary product and service offerings

- Looking across the functional-emotional orientation of an industry

- Looking across time

We examine each of these in detail in the series, but just to highlight some of the possibilities, you might, for example, in looking across alternative industries, look at what is going with self-publishing.

Udemy or Skillshare have already done this in taking the concept of book self-publishing and applying it to e-learning. We’d argue there are still niche opportunities in this area.

What if you were to provide a similar platform for your subject matter experts, perhaps by partnering with a company of this sort?

There are certainly opportunities in looking across strategic groups.

To understand what Kim and Maugborne mean by “strategic groups”, think, for example, of the luxury car market versus the economy car market.

Both fall within the same overall industry—automobiles. But sellers pursue very different strategies for serving essentially the same functional need. These kinds of differing strategic approaches within nearly every field or industry. And the lifelong learning market is no exception.

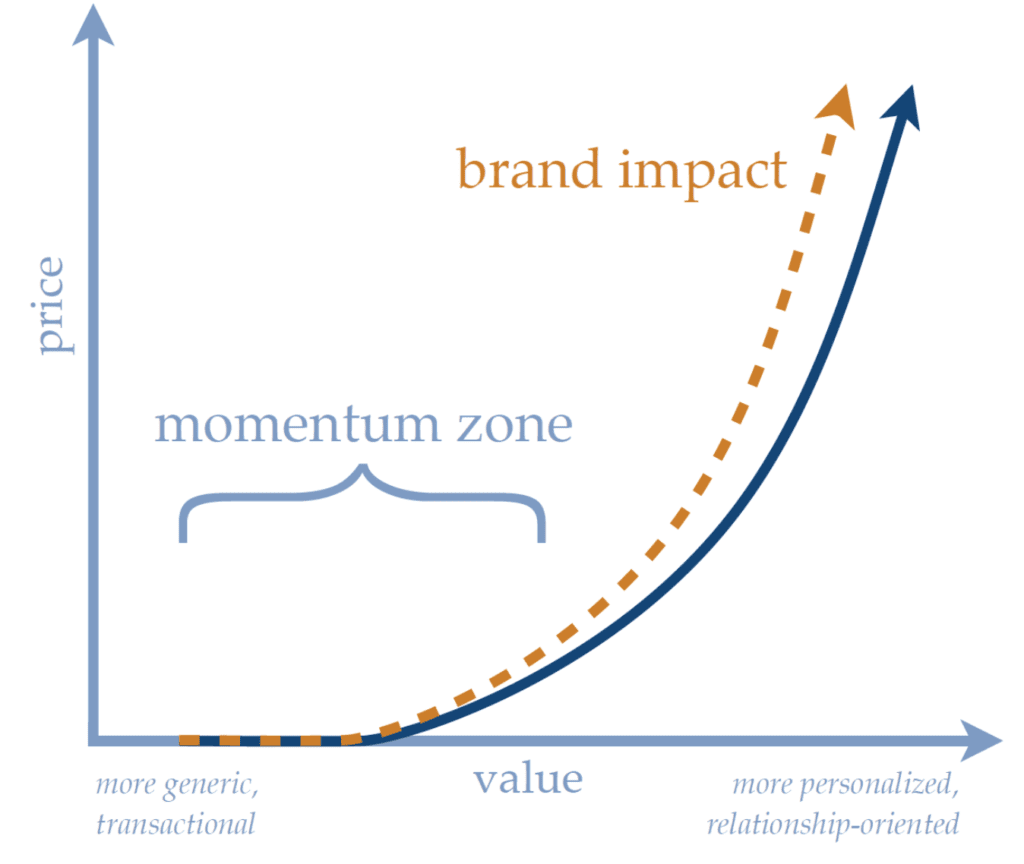

We’ve argued for years that there is a lot of focus around the middle of this market, where trade and professional associations, along with community colleges and university and college continuing education programs, compete on moderate price – moderate performance offerings.

Viewed in terms of the Value Ramp™ approach that we advocate, most of these organizations focus too much on the middle.

They often do not have much to offer at either the low price or high price end of their value curves.

There are typically opportunities at both ends of the curve, but they’re particularly excited about the possibilities for offerings that might be classified as “executive education” that could fill a gap in the upper part of the Value Ramp for most organizations.

Executive education is a roughly $1 billion market, traditionally housed within university business schools, in which customers (often corporate buyers) typically pay thousands, if not tens of thousands for non-credit, non-degree programs.

Executive education offerings may be open enrollment or customized, but in either case, they tend to provide relatively small group, intimate access to top-notch experts.

The traditional view has been that face-to-face interaction is necessary for the level of learning executive education aims to deliver, and the need for face-to-face interaction with relatively high-priced instructors has driven the cost structure.

But advances in technology, particularly those that are supporting much more dynamic and effective approaches to online collaboration and blended learning are making executive education a market ripe for disruption.

[17:40] – Those are just a couple of examples with just two of the paths, but again, there are other paths. In addition to looking across alternative industries and across strategic groups, there’s:

- Looking across buyer groups

- Looking across complementary product and service offerings

- Looking across the functional-emotional orientation of an industry

- Looking across time

We will leave it to you to explore those on your own. Or, better yet, to make this a collaborative project in which multiple people within your organization read the series and then get together to pursue “looking across” these paths to see what opportunities you find.

[19:18] – Wrap Up

If you are getting value from the Leading Learning podcast, be sure to subscribe by RSS or on iTunes. We’d also appreciate if you give us a rating on iTunes by going to https://www.leadinglearning.com/itunes.

Also, consider telling others about the podcast. Go to https://www.leadinglearning.com/share to share information about the podcast via Twitter, or send out a message on another channel of your choosing with a link to https://www.leadinglearning.com/podcast.

[20:48] – Sign off

See Also:

Member Loyalty and Learning with Amanda Myers

Member Loyalty and Learning with Amanda Myers

Leave a Reply