Year end is a natural time to pause for reflection. And that’s just what we did in a recent Leading Learning Webinar focus on the learning business landscape. In this article, we recap some key points from that session. You can also watch the recording of that Webinar below.

Our wish is that the points below provide fodder for your own reflection—that powerful engine of learning—and equip you to make educated guesses and craft hypotheses about what the learning business landscape of 2022 may look like and how that landscape might shape your own organization’s offerings.

To help us look at the 2022 learning business landscape, we draw on some data we collected via an online survey in late October and early November 2021. We received qualifying responses from 58 organizations.

How the Pandemic Shaped Learning Businesses in 2021

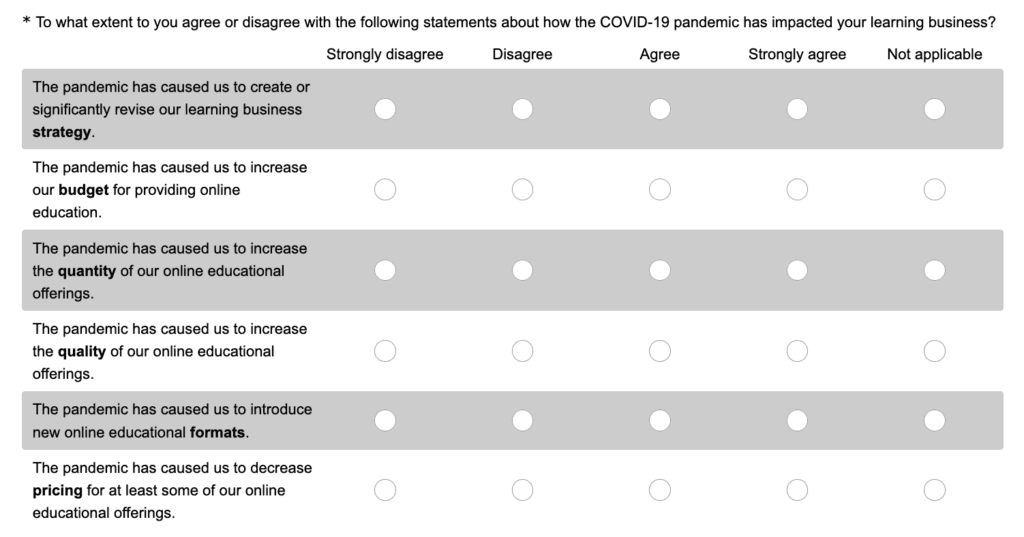

Given the profound impact of the pandemic on life, work, and learning, we asked survey respondents, “To what extent to you agree or disagree with the following statements about how the COVID-19 pandemic has impacted your learning business?”

- The pandemic has caused us to create or significantly revise our learning business strategy.

- The pandemic has caused us to increase our budget for providing online education.

- The pandemic has caused us to increase the quantity of our online educational offerings.

- The pandemic has caused us to increase the quality of our online educational offerings.

- The pandemic has caused us to introduce new online educational formats.

- The pandemic has caused us to decrease pricing for at least some of our online educational offerings.

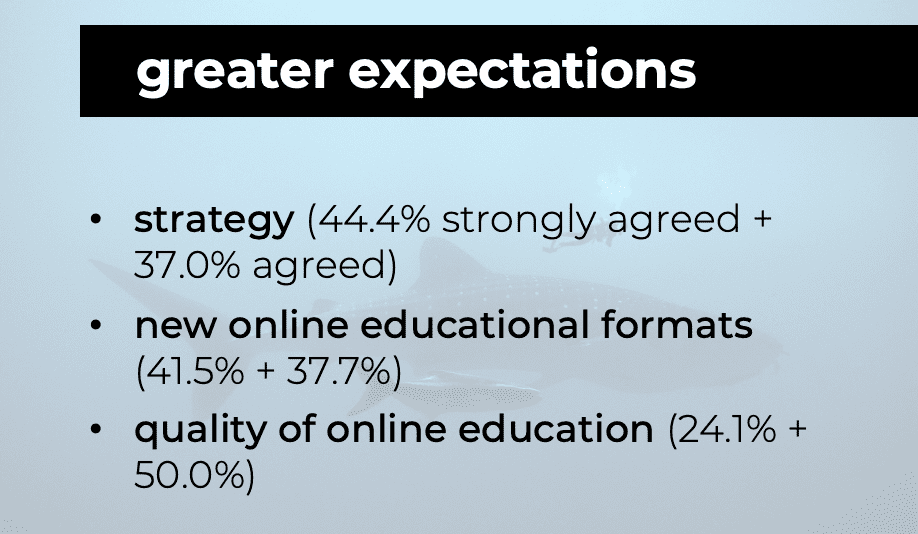

The top three—strategy, new online educational formats, and quantity of online education—were areas where more than 40 percent of respondents strongly agreed.

We find the emphasis on learning business strategy promising. It suggests that organizations are trying to not be in purely reactive mode; they’re trying to be proactive and craft a strategy that matches this current moment and and will carry them into a desired future.

The introduction of new online educational formats is not too surprising. In 2021, many organizations changed in-person conferences or seminars or courses to virtual, and some did it for the very first time, which means they added a new format to their portfolio of offerings.

The increase in the quantity of online educational offerings also isn’t surprising. Given that in-person education was impossible or difficult for much of the year, it makes sense that the amount of online education they offered would go up.

At the bottom of the list of six is decreased pricing. Only 9.3 percent of respondents strongly agreed that the pandemic caused them to decrease pricing for at least some of their online educational offerings. That surprised us a bit, as we had heard anecdotally about organizations that slashed pricing or even gave things away. Our hunch is that organizations did a good job making it clear that any price breaks were temporary and in response to the current moment, and so, in 2021, they were able to hold pricing steady, even if they’d cut pricing earlier in the pandemic in 2020.

Looking at the pricing question in the context of the other items that came in lower on the list can be illuminating. Here are the six areas ranked:

- Learning business strategy (44.4 percent)

- New online educational formats (41.5 percent)

- Quantity of online education (40.7 percent)

- Quality of online education (24.1 percent)

- Budget for online education (18.5 percent)

- Decreased pricing (9.3 percent)

What’s interesting in the ranking is that it’s going to be increasingly hard to hold pricing for online education steady—much less increase it—without improving the quality (fourth in this list), and improving the quality is likely to require an increase in budget (fifth in the list).

It will be interesting to see if the pandemic-driven shift to doing much more learning online has a longer-term impact on the pricing of face-to-face events. Online offerings, rightly or wrongly, tend to be priced lower, and that could exert downward pressure on face-to-face offerings. Or we could see the opposite happen—face-to-face could be positioned and priced at a premium. We can imagine it going either way. With respect to pricing and otherwise, it feels like 2021 was the beginning of a great experiment—and it’s far from clear at this point how it will all turn out.

What Learning Businesses Plan to Tackle in 2022

We asked survey respondents to let us know which of 14 areas of activities they’re already engaged, planning to pursue in the year ahead, or not planning to pursue.

- Creation of learning experiences that combine online elements with face-to-face elements

- Implementation of technologies that leverage artificial intelligence to support or enhance learning

- Microlearning opportunities

- Providing a personalized learning experience

- Creation of social or peer-to-peer learning experiences

- Use of virtual reality or augmented reality to provide new learning experiences or enhance existing experiences

- Use of virtual conferences—i.e., an online event similar to a traditional face-to-face conference, not just a single Webinar

- New or alternative approaches to credentialing, including certificate programs, microcredentials, and digital badges

- Aligning our offerings with specific career or job paths relevant to learners—e.g., through a competency model, learning pathways, or targeted curricula

- Integration of our educational offerings into the learning and development programs of employers in a field or industry or into general workforce development needs

- Development of strategies or tactics to help combat declining enrollments, downward price pressure, or “commoditization” of educational offerings

- Increased efforts to gather and analyze data to inform new product decisions or improve existing products

- Increased efforts to gather and analyze data that demonstrates the impact or effectiveness of the learning experiences offered

- Implementation of methods to ensure that learning is retained and applied over time

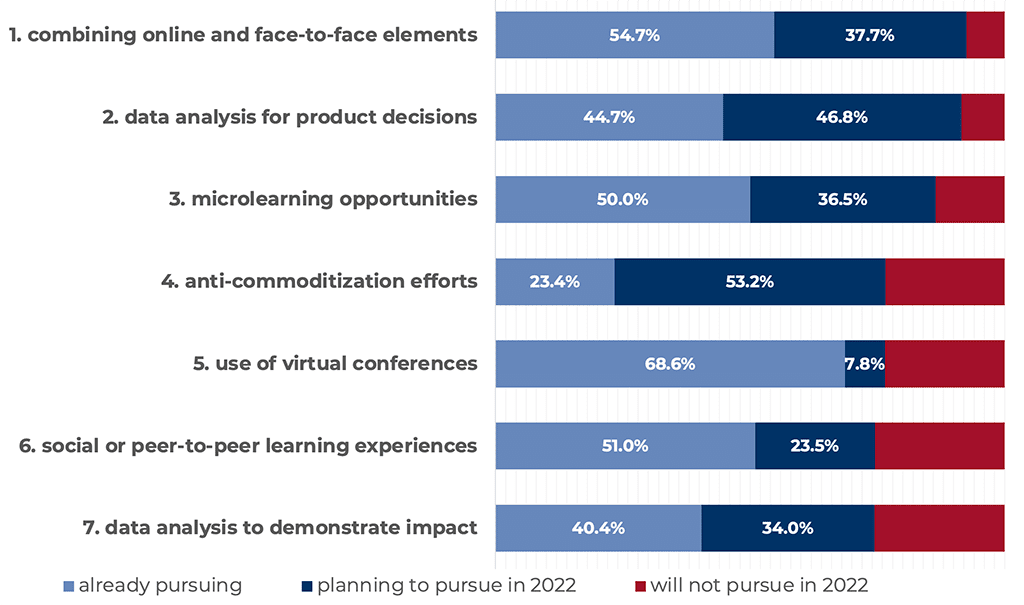

Seven of the 14 areas are either being pursued or planning to to be pursued in 2022 by roughly 75 percent or more of responding organizations. Here are those the top seven. (To rank these, we grouped responses from folks already pursuing that area and those planning to in 2022.)

At the top is “creation of learning experiences that combine online elements with face-to-face elements” with a whopping 92.4 percent of respondents already doing it or planning to in 2022. (This came in fourth last year.) We see COVID’s impact in the growth here and the growing prevalence of blended learning.

Second is “increased efforts to gather and analyze data to inform new product decisions or improve existing products” with a combined 91.5 percent either already doing it or will be by the end of 2022. This was first last year. We’re proponents of the power of marketing—big-picture marketing that goes far beyond just promotion and really starts with product development—and using data to understand what products need to be made and which need to go away and how to improve offerings is simply good business practice.

Third in the list is “microlearning opportunities” with 86.5 percent doing it or planning to. While microlearning isn’t new, it may finally be hitting maturity. Microlearning has the ability to speak well to some of the current moment’s realities and issues, including the potential to address Zoom fatigue and virtual burnout. Microlearning by definition requires a shorter online commitment, so it may be more palatable for learners to access microlearning than a longer Zoom Webinar, for example. Microlearning also gives you the chance to offer something at a lower price point on your Value Ramp, so learners who can’t afford an eight-hour seminar or a multicourse bundle or all-you-can-eat access to offerings might still find something of value that they can afford in your portfolio—and, through continued contact with you through that microlearning, they’ll be more likely to buy that longer seminar or course bundle from you when they can afford it.

Learning businesses, though, are going to need to get good at microlearning to capitalize on the opportunity. Developing effective microlearning entails understanding how to chunk content and craft an actual learning experience that can take place in a short time. And making microlearning an effective part of your portfolio of offerings entails figuring out its place in your strategy.

Fourth is “development of strategies or tactics to help combat declining enrollments, downward price pressure, or ‘commoditization’ of educational offerings” with 76.6 percent doing or planning to do something in that area. Commoditization concerns and downward price pressures aren’t new, especially in highly competitive fields like continuing medical education (CME) and continuing legal education (CLE), where learning businesses have to compete with free offerings or cheap all-you-can-eat options. But, over the course of 2021, COVID pumped up the amount of online learning available and the number of virtual conferences, so more learning business are trying to figure out how to do online learning and virtual conferences really well and/or how to take a unique approach so they stand out and don’t become a commodity that learners choose—or don’t choose—solely based on price.

“Use of virtual conferences” is fifth with a combined 76.4 percent either already doing it or will be in 2022. Most organizations have had the chance to try virtual conferences by now—or been forced to try it, in some cases. Some are unconvinced of the value or counting on being able to return to relying on in-person conferences. That said, we think that any organization that offers conferences probably should have some virtual conferences in the mix going forward.

Sixth is “creation of social or peer-to-peer learning experiences” with 74.5 percent doing it or planning for it. The focus on social and peer-to-peer learning makes great sense in the context of 2022. Social learning is incredibly effective, and the pandemic deprived many of us of some of our usual social interactions. So, in this moment, social and peer-to-peer learning are doubly appealing—they can be effective learning approaches, and, if they provide learners with some connection to others, that’s an added benefit.

Seventh in the list and the last item where about three-quarters or more of respondents were doing it or planning to do it in 2022 is another data area: “increased efforts to gather and analyze data that demonstrates the impact or effectiveness of the learning experiences we offer” with 74.4 percent doing that or planning to in 2022.

To go along with the survey data, we’ll share three trends. Learning businesses that embrace these trends—and act on them—will be well positioned for 2022 and beyond.

- Greater expectations from learners

- The intentionality imperative

- The great rebalancing

Greater Expectations from Learners

Learners have greater expectations now than ever before. The pandemic accelerated a trend that has been in progress for years. Competition in the third sector was already pretty fierce, but with the emphasis on online in 2020 and 2021, we’re seeing organizations bump up against new competitors—entities that didn’t offer online education before and so weren’t really an option for your learners now are. Your learners have more options than ever, and your learning business has more competitors than ever. You have to do more to stand out and be heard in this increasingly noisy learning landscape.

Many organizations made quick pivots and took stopgap measures in 2020 and 2021. While stopgap measures and shortcuts may have been acceptable—or at least understandable—during the extraordinary times of an emerging pandemic, there’s a lot less tolerance for subpar online learning content now, and there will be even less moving forward.

The greater expectations learners have leads naturally to the next trend.

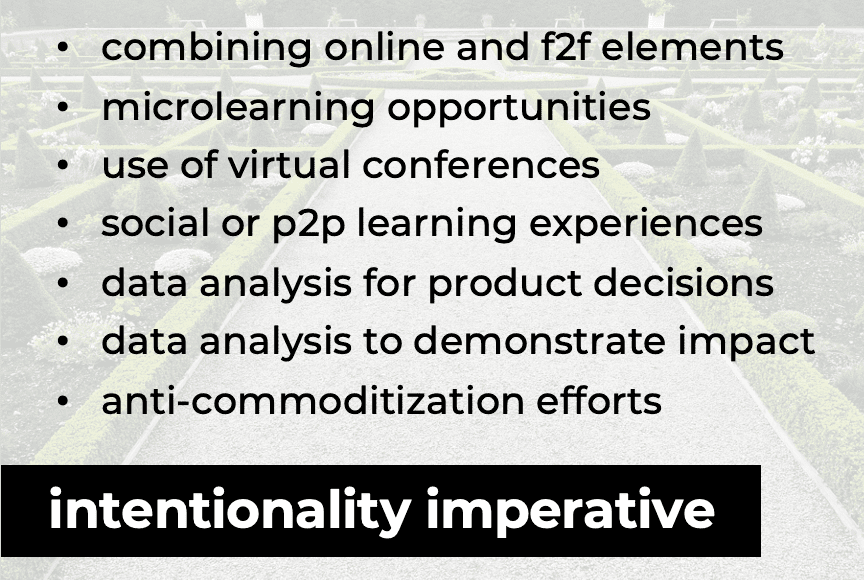

The Intentionality Imperative

To respond to the greater expectations that learners have, learning businesses need to be more intentional. That intentionality should permeate all levels of the learning business. It should impact the high-level strategy, and it should extend to the product level—we have to be intentional about what we’re designing and developing and how we’re delivering it.

Arguably all seven of the top areas of focus for learning businesses per the survey data shared earlier speak to getting more intentional. Combining online and face-to-face elements requires understanding and thinking through the benefits and shortcomings of different delivery options. Thinking through how to leverage microlearning, when to use virtual conferences, and how to integrate social or peer-to-peer learning all presuppose being more intentional about what approach works when and for whom. Gathering and using data to inform new product decisions or improve existing products is definitely an intentional approach. Ditto for collecting and using data to demonstrate the impact or effectiveness of your learning products. And developing strategies or tactics to help combat commoditization takes an intentional focus as well.

We heard about increased intentionality in the open-ended comments from survey respondents and in other conversations and exchanges we’ve had with those working in learning businesses. One survey respondent said their organization is focusing on specializing in 2022. Pre-pandemic, the organization offered a broader slate of options. Now they’ve refined what they offer to better align with their expertise.

Another organization is focusing concerted efforts on pursuing business-to-business (B2B) opportunities for the bulk sale of courses and thinking through what that B2B focus requires—from the staff needed to sell those deals and handle contracts to the technology needed to deliver the online courses to the organizational customers.

Another learning business is being more intentional about its diversity, equity, and inclusion (DEI) efforts in 2022. It’s focusing on routinizing its DEI efforts—doing the somewhat unexciting but important work to bake DEI into course proposals and other operations to make sure that the DEI efforts don’t rely on a single champion.

In a similar vein, another organization is looking at baking a green, environmental focus into all its learning, not just courses specifically about the environment or climate change. And, of course, online learning has huge potential in cutting down on the climate impact of learning by reducing the use of planes for travel, for example.

The Great Rebalancing

We believe the intentionality imperative is almost certain to lead to what we’re calling the great rebalancing. The pandemic pushed many individuals and organizations out of balance. Many went into survival mode. With a focus on intentionality, though, we predict a rebalancing across the learning business landscape.

The great rebalancing will require portfolio changes. Determining an appropriate, effective balance combination of face-to-face and online will be part of the great rebalancing, and that will involve navigating the desire to return in-person events with the convenience, greater reach, and cost-savings of virtual events. Part of that navigation will mean getting clearer on why to gather in person and it may tip organizations towards gathering in person primarily (or only) for some purpose that can’t be replicated online.

In addition to questions of rebalancing face-to-face and online learning, there are also questions around how much of your portfolio is or should be asynchronous versus synchronous and how much should be broadcast versus participatory. The goal, of course, is to use each modality and format for its strengths and combine strength with strength for the most effective, powerful learning experiences.

Another area to rebalance is personalized learning versus prescribed pathways. Many organizations have work to do to figure out the balance of how much to dictate and how much to leave open-ended. And the question of how much to personalize and how much to prescribe can be complicated in highly regulated fields.

A last big area that needs rebalancing in many organizations is meetings versus education. The meetings/education tension predates COVID, but the pandemic exacerbated it. Many learning businesses offer both meetings and conferences on the one hand and educational products, like courses, on the other, and often different groups in the organization manage those separately. Historically, for many organizations, the meetings and conferences were in person. COVID moved those online. And so now, within an organization, the amount of online content has jumped hugely, and learners are sometimes left trying to sort out the difference between an online course and a conference session recording on the same topic.

If learning businesses don’t help learners understand their options, then they risk cannibalization—a learner who historically went to the annual meeting and bought some online courses may wind up doing one or the other. When cannibalization is discussed, it’s usually in the context of worrying that a virtual conference will hurt in-person attendance when offering both in-person and virtual options. There’s lots of data that says that kind of cannibalization is a myth. But it strikes us that virtual event content could cannibalize online course content if learning businesses don’t do the work to become more intentional about what they’re offering and do the work to rebalance.

Barriers: Technology and People

We didn’t ask about barriers in the online survey, but in some supplemental exchanges and discussions we had with those working in learning businesses, we heard about barriers organizations are hitting or anticipate hitting as they pursue their plans for 2022. In almost all of those exchanges, the barriers boil down to capacity, specifically technology and people.

On the technology side, learning businesses are often looking for a solution to help with them a strategic goal. For example, they’re seeking a platform that allows not only business-to-consumer sales direct to learners but also facilitates the B2B organizational sales model. Or a platform that automates a subscription model for learners and automatically charges a credit card each year. Or a technology with good artificial intelligence that can help personalize learning for individuals. So learning businesses have a specific vision and need but are struggling to find the right technology at the right price point to support that vision.

On the people side, we’re experiencing what’s being called the Great Resignation. Many learning businesses down a team member or two and struggling to do everything they have to do (and more!) with fewer resources. And there’s fierce competition as they look to hire team members with the needed skills, knowledge, and mindset.

Food for Reflection—and Action

We hope this data from your learning business peers and these three learning business landscape trends offers some food for reflection—some topics and ideas to help you think about the priorities for your learning business in 2022 and the possibly barriers you may have to overcome.

But we also hope you don’t stop at thinking. We hope you get to action too. We wish you all the best in 2022 as you take action and navigate the learning business landscape.

Jeff & Celisa

See also:

Now’s the Time: The Year That Was

Now’s the Time: The Year That Was

Leave a Reply